Recently India has been standing with its head held high and witnessing so many feathers getting added to its cap. Where startups are queuing up in the race to turn into unicorns at such a rapid pace. By now, we can already see so many startups raising exponentially high funds setting a neck-to-neck competition for each other.

Zeta, a Bengaluru-based banking tech start-up, co-founded by billionaire and serial entrepreneur Bhavin Turakhia, who had earlier established companies like Radix, Directi, chat platform Flock, and coding company Codechef has proved his grit with yet another success story.

Where, his most recent startup, has raised $250 million from SoftBank Vision Fund 2 and existing investor Sodexo recently making it India’s 14th unicorn. This Series C fund-raise makes Zeta’s valuation at $1.45 billion, which enabled it to join the coveted unicorn bandwagon.

Zeta Joined The Unicorn Club

Zeta has joined the unicorn group of earlier 13 startups that had a mark for themselves in the Indian industry, the most recent ones include companies like FamPay, Moglix, BrowserStack, Urban Company, ChargeBee and Gupshup.

India now possesses 51 unicorns, with the list including other companies like Groww, Pharmeasy, Cred Meesho, etc. Not just this, but we witnessed a commendable success stories series in the year 2020 too, where a dozen startups like Razorpay, PineLabs, Zerodha and Postman had won the race and had entered the much sought-after unicorn clan. That was the highest-ever in a year according to the Indian Tech Unicorn Report 2020. At $16 billion, fintech giant Paytm continues to hold a strong grip in the market and stands amongst the most valuable unicorns along with ed-tech startup Byju’s.

Therefore, the growing digital world signifies evolving security, privacy and data protection challenges for the banks. Where, most importantly, the industry requires systems reinvented with strong security, privacy, scalability and reliability as its basic foundation.

Zeta Startup Highlights

| Startup Name | Zeta |

| Company Legal Name | Zeta Services Inc. |

| Founded | 2015 |

| Headquarters (U.S) | San Francisco, California |

| Company Office (India) | Bengaluru, Karnataka, India |

| Founders |

|

| Startup Industry | SAAS, Internet, Payments, Financial Services |

| Employees | 500-1000 |

| Transactions Per Year | 300 Million+ |

| Cards Issued | 10 Million+ |

| Recent Funding Round | Venture Round on March 7, 2022 |

| Recent Funds Raised | $30 Million |

| Total Funding Rounds | 3 |

| Total Funding Raised | $340 Million |

About: Zeta Company

Founded in the year 2015, Zeta is a banking tech company that offers a full-stack, cloud-native API-ready core neo-banking and transaction processing platform for issuing credit, debit, and prepaid products. This enables legacy banks and financial institutions to launch modern retail and corporate fintech products.

Zeta’s customer list consists of brands like Sodexo, HDFC Bank, Kotak Mahindra Bank, Axis Bank, IndusInd Bank, Yes Bank RBL Bank, etc.

In the initial stage, Zeta had begun providing a range of employee benefit services like a cloud-based smart benefits suite known as Zeta Tax Benefits to the employees. This enabled employees to digitize all sorts of tax-saving reimbursements and its digital cafeteria solution, Zeta Express.

Nonetheless, in the month of July in the year 2019, it merged the employee benefits business with Sodexo Benefits and Rewards India (BRS India).

Zeta Funding & Company Goals

The company Zeta, founded by Bhavin Turakhia and Ramki Gaddipati has customers including banks and fintech, having its presence in North America, LATAM, UK, Europe and Asia. The founders aim at utilizing the main portion of the funding towards accelerating the global expansion, where the company is launching in the Middle East and is set to increase its presence in Latin America, and South Asia too.

The company’s ultimate goal is to become the de facto banking tech platform at a global level. Based on the existing contracts alone, in the next 4-5 years the platform is anticipated to gain 70 million users. This will make the company turn into the largest Neo Banking platform present in the world.

Talking about the company’s employee strength it currently counts to be about 450-500 employees working from over 11 Indian cities viz. Mumbai, New Delhi, Hyderabad, Bengaluru, Chennai, Pune, Kolkata, Nashik, Vadodara, Kochi and Ahmedabad.

$300 Billion Industry

Seeking Banking software into consideration it is a $300 billion industry globally. And as per Zeta investors, most banks still take on technology that is quite older than their customers. Notably, these banks are putting into use decades-old software, which was built when mainframes and Cobol were in trend. Also, they have been innovating at a very slow pace, making the user experience and engagement poor.

Whereas, Zeta’s modern Omni Stack will drive banking software upgrades, which will serve the digital consumer and innovations in financial services at a global level. Through Zeta’s modern Omni Stack, financial institutions will be able to leverage the most recent cloud-native platform that will help in improving the speed to-market, agility, cost to income ratio along with the creation of a rich user experience.

Not just this, yet in today’s times, the world is moving towards real-time payments and digital financial services, where the number of transactions executed each day between banks and customers is anticipated to grow rapidly.

How did Zeta start?

At the early age of 18 years, Bhavin Turakhia stepped into the entrepreneurial world, establishing his first venture Directi along with his brother Divyank Turakhia. When Bhavin realized that his company was growing, he paved his way toward various other sectors and founded several new companies.

Both siblings witnessed huge success Bhavin Turakhia is worth $1.3 billion, and his brother Divyank also stands to be a billionaire, having sold Media.net for $900 million to a Chinese company.

Zeta stands at the second position of being an Indian unicorn which has been created by these successful Indian founders and by turning into a unicorn, the founders present how lightning can indeed strike twice.

Zeta: Business Model

The company Zeta works on a B2B2C model, where it functions as a technology service provider that provides its tech-based products to banks and fintech businesses. With no definite revelation of the pricing, Zeta charges the banks based on the number of transactions or the number of customers.

For now, it has a revenue-sharing model for fintech startups.

The company’s solutions are being utilized by BFSI issuers in India, Asia, and LATAM. Zeta counts banks like RBL Bank, IDFC First Bank, and Kotak Mahindra Bank as its clients, along with 14,000 corporates. Under this, 4 million users use Zeta via their banks and other financial institutions.

Moreover, the company’s business has risen amidst the Covid 19 pandemic as the scenario forced people to switch to digital modes of services in the course of the lockdown.

Zeta Suite Logo

Zeta Founders and Co-Founders

Bhavin Turakhia: Co-Founder & CEO

Bhavin Turakhia did his schooling at the Arya Vidya Mandir school located in Bandra, Mumbai. Since childhood, he was engrossed in coding and has spent a lot of his time in it. Interestingly, when he was just 8 years old his father bought him his first coding book. He spent all his short breaks, lunchtime, and several hours after school each day in it.

His dad bought him a lot of programming books, and he used to go through them back to back. He went through more than 25-30 different books in order to learn programming and GW-BASIC, Visual Basic, and C++ on MS-DOS back in those times.

After this, he later joined DG Ruparel College but dropped the course during the midterm itself. According to him, he discontinued his studies as he learnt most of the syllabus by himself. Moving on, he then pursued his bachelor’s degree in commerce from Sydenham College of Commerce and Economics.

Now, he is a billionaire and serial entrepreneur, who was earlier the founder of 5 companies such as Flock, Resellerclub, Radix, BigRock, CodeChef, etc, and is the CEO of Zeta. He is a role model for many budding entrepreneurs and through a series of technology-led innovations, he endeavoured through his ventures to solve problems and maximize efficiency.

In the year 2014, all these companies were sold in a deal worth $160 million, wherein the present he heads Radix, a leader in the registry for top-rated extensions, Flock, a portfolio of productivity apps, and of course Zeta is a platform for digital payments.

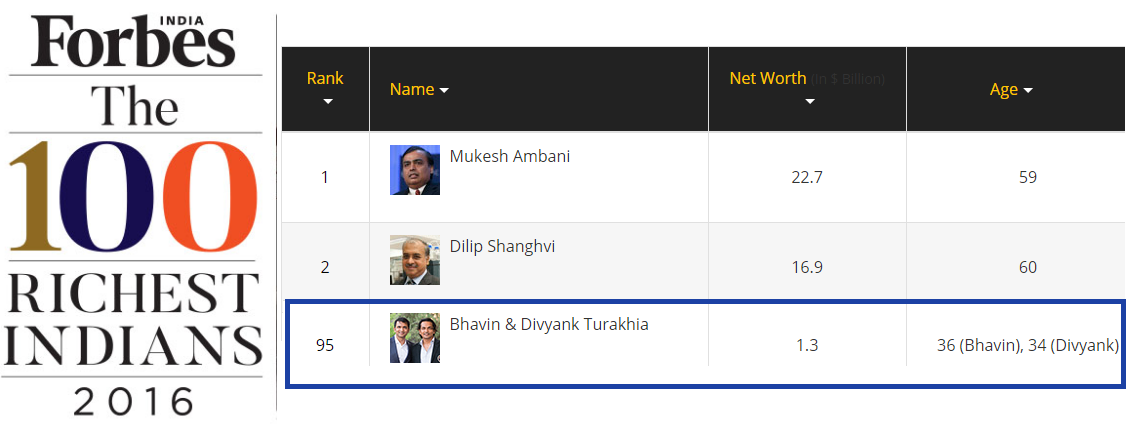

Owing to so much consistency in his achievements, in the year 2016, according to Forbes Bhavin stood amongst the 95th richest persons in India, with a net worth of US$1.3 billion, along with his brother Divyank Turakhia.

Ramki Gaddipati: Co-Founder & CTO

Ramki Gaddipati holds a Master’s degree in Management and a Master’s in Software Systems from Birla Institute of Technology and Science (BITS), Pilani. For a span of 7 years, he had been engaged with the Directi Group, where he led various tech initiatives in several capacities.

Later, he co-founded Bridle Information and Technology Solutions and in the year 2006, he was listed in Asia’s Best Entrepreneurs Under 25 by Business Week.

He is now the Chief Technology Officer and the Co-founder of Zeta. Where in India the company Zeta is the fastest and most convenient way to make payments. At Zeta, his role in the company is to lead a strong team of engineers to give the product a stable foundation.

He comes across as an extremely passionate professional when product engineering is concerned and possesses a strong sense of initiative and commitment toward achieving excellence at each step.

Zeta: Core Team

Co-Founder & CEO: Bhavin Turakhia.

Co-Founder & CTO: Ramki Gaddipati.

Leadership Team

President, Banking: Gary Singh

Zeta Board Members

- Ramakrishna Gaddipati, Director

- Priya Turakhia, Director

- Mehul Turakhia, Director

Zeta Funding History & Investors

| [Zeta Funding Rounds] | [Zeta Funding Amount] | [Zeta Investors] |

| Nov 2015 – Seed Round | $1.83 Million | Directi |

| Jan 2016 – Series A | $8.08 Million | Directi |

| July 2019 – Seed C Round | $60 Million | Sodexo |

| May 2021– Seed C Round | $250 Million |

|

| March 2022 – Venture Round | $30 Million | Mastercard |

| Total Zeta Funding: $340 Million | ||

| Total Valuation (May 2022) | $1.5 Billion (approx) | |

In the last 6 years, Zeta has raised a total of $60.0M or a total of $24.8K per employee. Having raised this capital resulted in the dilution of Bhavin Turakhia in spite of non-dilutive funding options such as Founder-path.

Zeta had to sell for $600M to keep the investors happy.

Geographically this Bengaluru-based company, 33 SaaS startups have raised a total of $18.5M over the past 10 years. In the year 2019, Sodexo, which had earlier invested under $60 million, participated in the round with $10 million in funding.

Where Avendus Capital was the exclusive financial advisor for Zeta in this deal. Outstandingly, the company’s latest valuation is said to have jumped 4.8X from its last round.

Zeta Valuation

Zeta, the banking technology platform, has recently raised $250 million in a Series C funding round backed by SoftBank Vision Fund 2, which gave this company a valuation of about $1.5 billion.

This funding marks the biggest backing by a single investor in the banking tech startup space across the world where the earlier investor Sodexo had also participated in this round as a minority backer, and Avendus Capital acted as the financial advisor.

Earlier investments by SoftBank India included the logistics firm Delhivery, eyewear retailer Lenskart and Mindtickle who have been more on the conventional and less challenging side. It is believed that Zeta is a different bet for SoftBank as the average value of an individual contract is far higher than any regular SaaS company. A regular SaaS company can get around $3-4 million from one company in the US.

However, Zeta can get more than $50 million from a single bank, hence, SoftBank bets that if Zeta can achieve this milestone even for a dozen clients (where their target is for 300), they will definitely have enough revenue to justify a multi-billion-dollar valuation. The massive market catered by Zeta, its seasoned founders and the funding hysteria along with gripping Indian startups offer more repeatability to the valuation making it unique.

Seeking this funding into perspective, Bhavin mentioned “This is one of the largest single investments in a banking-tech start-up globally. We will be using the proceeds to accelerate Zeta’s growth in the US, Europe and India, which includes scaling its operations, team and platform to meet the demands of its expanding customer base.”

Also, the founders plan and aim at disrupting the banking space and becoming the leading player in this space thereby becoming the default one-stop solution for all digital banking needs. In this endeavour, it competes in India with Financial Software and Systems (FSS) and First Data.

Zeta Website | LinkedIn | Facebook | Twitter

Additionally, it also faces international competition from Marqeta and Galileo Financial Technologies. Zeta aims at shooting for the stars, wanting to disrupt banking software, an area that has not witnessed innovation for more than 2 decades now.

Also Read:

- BrowserStack Funding and Success Story

- Delhivery Funding History and Success Story

- FamPay Funding History and Success Story

Zeta: FAQs

What is Zeta’s valuation in 2022?

Zeta after raising a total of $340 million in a Series C, venture funding round, company’s valuation raised to $1.45 billion.

What is Zeta’s funding status?

In Nov 2015, seed round Zeta raised $1.83 Million, after that in Jan 2016, series A round, Zeta raised $8.08 M, then after about 2 years in July 2019. seed C round Zeta raised $60M and now recently in May 2021, in a seed C round, Zeta raised a massive $250 Million in funding from SoftBank Vision Fund and Sodexo.

Who are the founders of Zeta?

Mr. Bhavin Turakhia and Mr. Ramki Gaddipati are the co-founders of Zeta.

When did Zeta start?

Zeta Services Inc. was founded in 2015 by two co-founders Bhavin Turakhia and Ramki Gaddipati.